Tokenisation and digitised assets are often talked about as technology that will widen the reach of the financial markets: making more asset classes available to more people, creating liquidity, wealth and financial inclusion as a result.

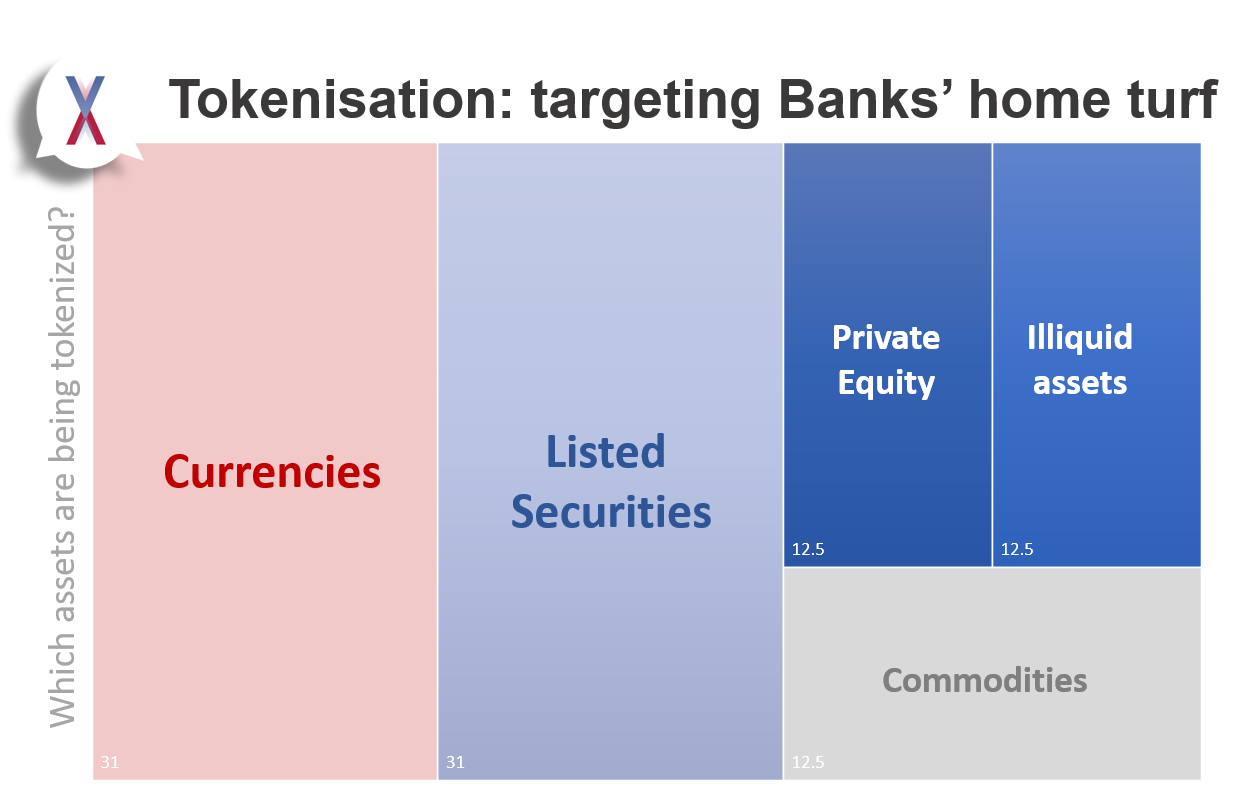

But our poll shows that the true target of tokenization is core banking territory: as market participants seek greater security and cost efficiencies in the same way that the did during the dematerialisation of securities.

Tokenisation is a journey: with a clear destination

Digitized assets are no longer a future trend. 60% of our respondents claims to have already dealt in or with digitized currencies: a market that has been transformed by this technology in almost no time. Once the exclusive domain of the world’s banks, cross-border payments are, today, up to hundreds of times faster and cheaper – thanks to the blockchain backbone that allows them to be tokenized.

And the revolution is beginning too in illiquid, paper-based assets (such as venture capital or physical assets). Growing numbers of live projects are increasing participation in and liquidity of previously niche and hard-to-trade assets.

But the real target is core banking territory. The world’s listed securities markets are cited by 35% of respondents as their core focus for digitization: as they seek to replicate the radical cost efficiencies and increased liquidity from the payments industry in this new market.

The (digitized) gift that keeps on giving

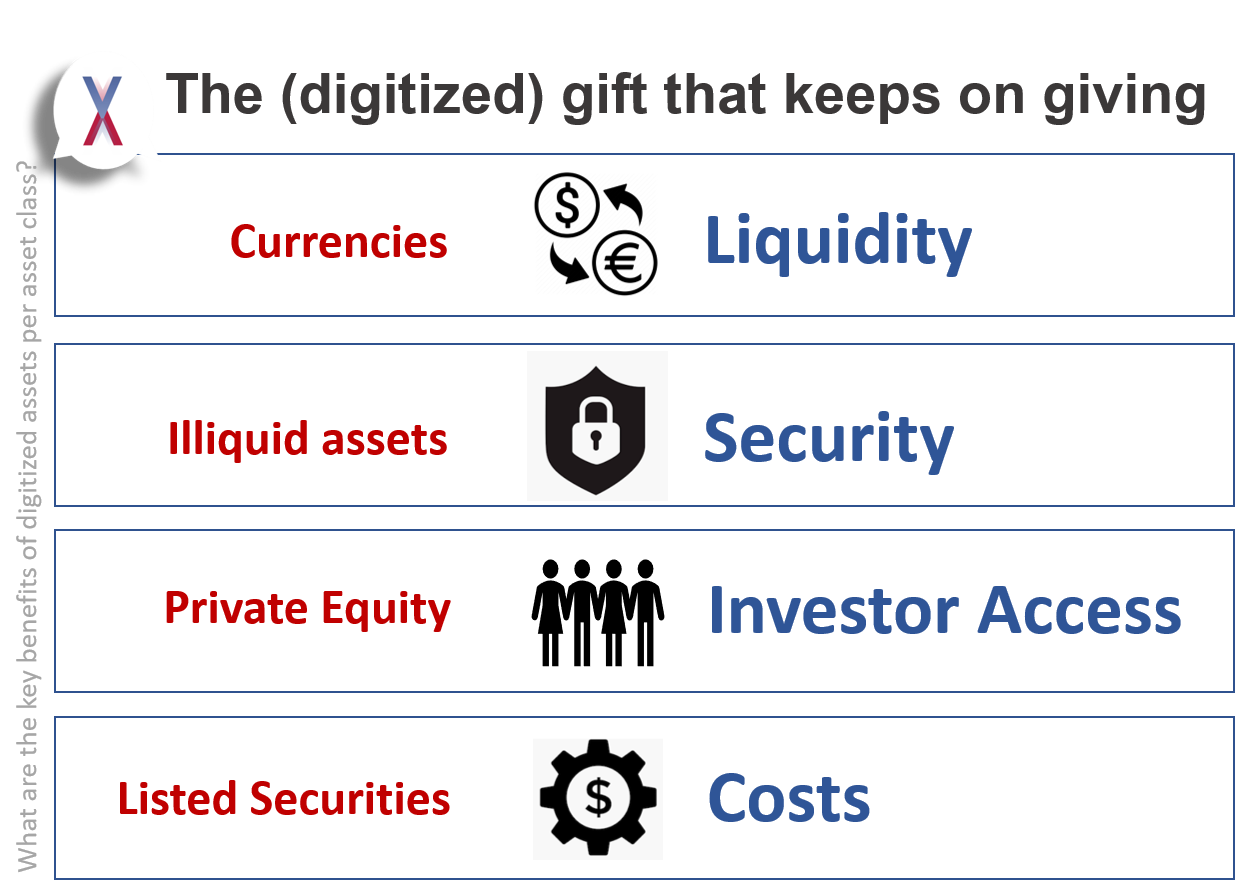

Whilst cost reductions and security improvements are seen as the two headline benefits behind digitized assets, these different usage cases are making progress for different reasons.

Successes in the payments industry have indeed led to increased financial inclusion (particularly amongst the world’s unbanked), with lower costs driving liquidity exponentially. In the ‘paper’ space such as venture capital and real estate, the key perceived benefit is investor access and security (for 29% of respondents): as investors seek to diversify their investments into these new assets without having to price-in significant amounts of operational and market risk.

The listed securities industry appears ready to re-invent itself. In a context of cost-cutting and cyber-attacks, the hope is that digitized assets can bring efficiencies of a scale not seen since dematerialization began in the 1960s: where massive cost efficiencies (cited 25% of respondents as priority) and security improvements (17%) combine with increased liquidity to deliver a huge jaw effect.

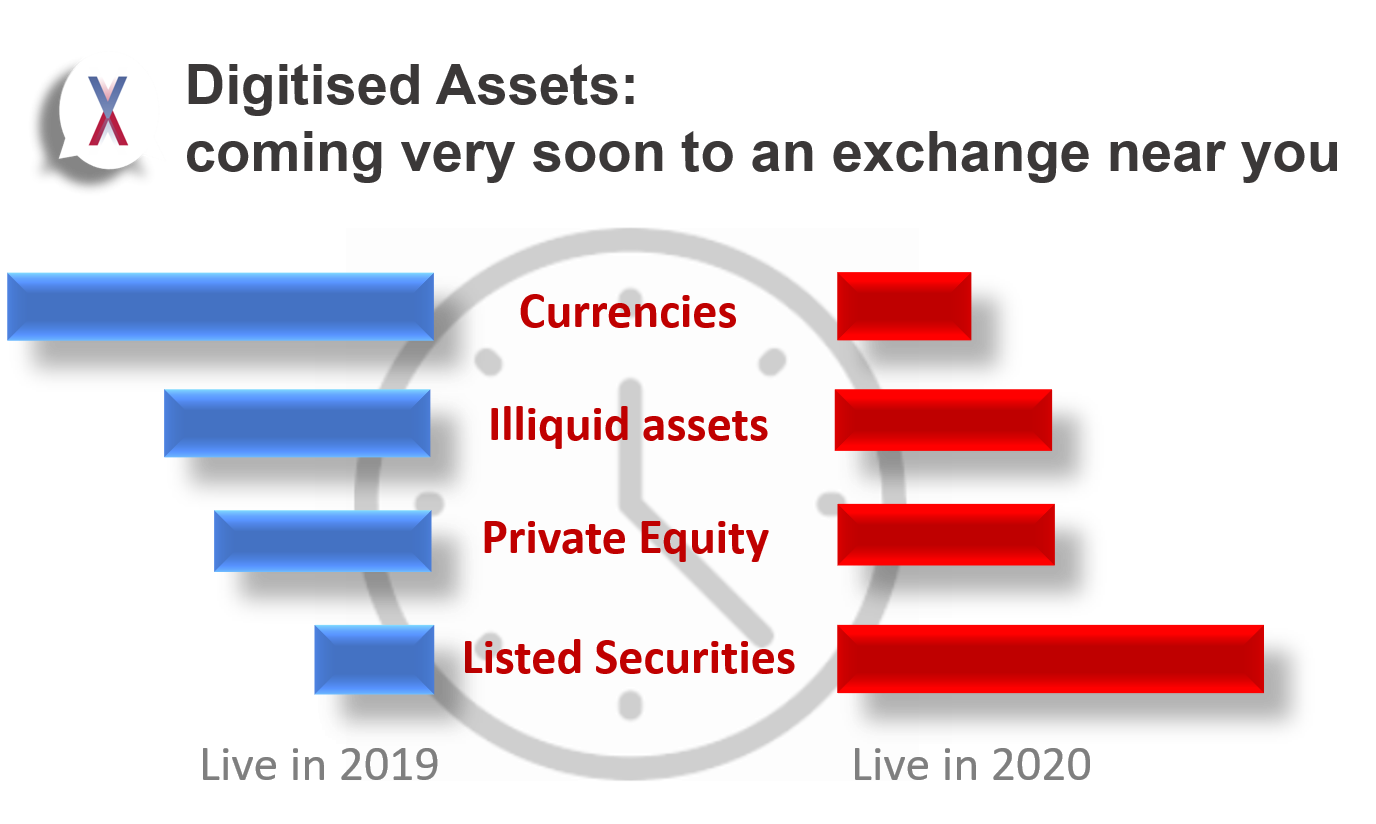

The Clock is Ticking: Fast

Judging by the speed of transformation in the word’s payments industry, it is not surprising that over 60% of respondents are planning to be trading and holding digitized (listed) securities within the next 15 months. People are counting on rapid change.

But can exchanges, banks and regulators change at the pace that they need to (in a post-subprime and post-GFC world) – in order to bring transformation to the securities industry? Can regulators forge a consensus on how these assets should be classified? Can exchanges embrace the technology and transform trade flows to the level where security and processing costs are optimized? Can Banks and institutional investors teach themselves how to supervise and manage the risks of this new world? It seems like a very big ask.

But they’ve done it once before.

What do I do now?

We need to be getting ready. Could we complete an in-depth due diligence on tokenized asset safekeeping? Do we know what risk indicators we need to be tracking? Aside from saving some money when we send money abroad, we all need to be preparing ourselves to hold digitized assets very soon. We probably can’t afford not to.

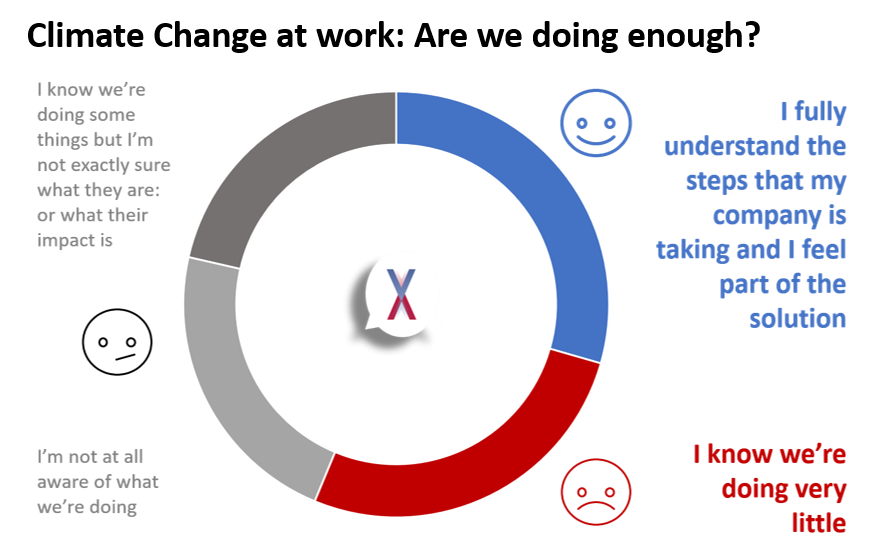

Dont forget to vote in this week’s poll on Climate Change: https://na1se.voxco.com/SE/207/8Oct/

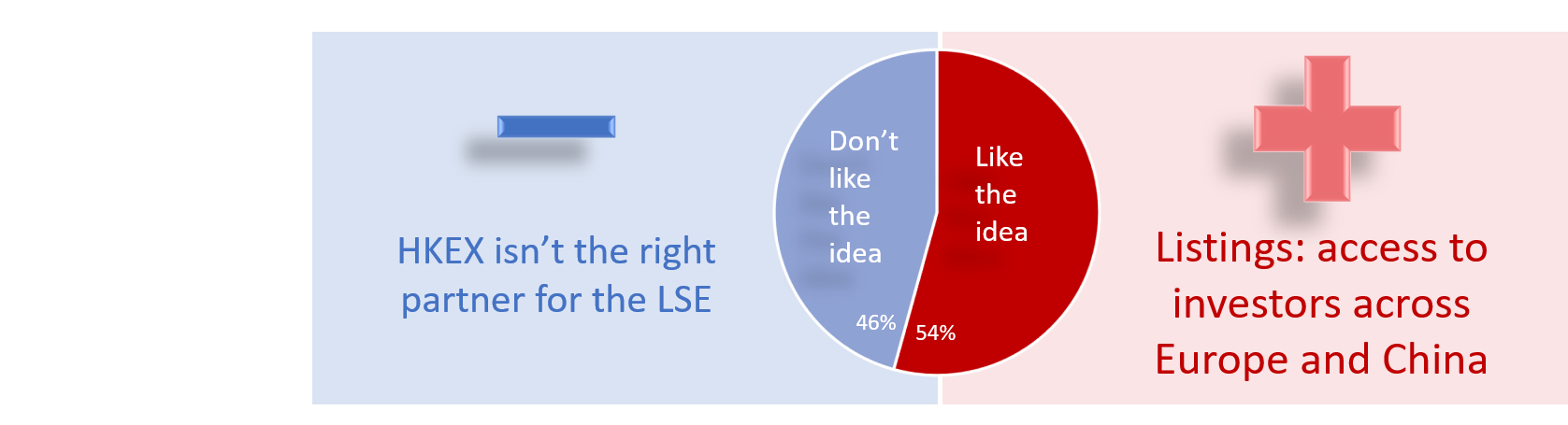

Poll details: This week’s poll was distributed to over 1,500 financial professionals across Asia, Europe and North America. For the sake of context, approximately 38% of respondents were located in Hong Kong; 20% in Europe. Views given above are based on how respondents ranked a number of positive and negative statements about the deal.