The finance industry employs millions of people and is responsible for the direction of trillions of dollars in investments every day. So how well do the people inside the industry feel we’re doing in the face of what is arguably the greatest crisis of our time?

We should be in absolutely no doubt: we are doing a terrible job. We may all be actively engaged at home and on social media – but as employers and employees in financial institutions, we are failing.

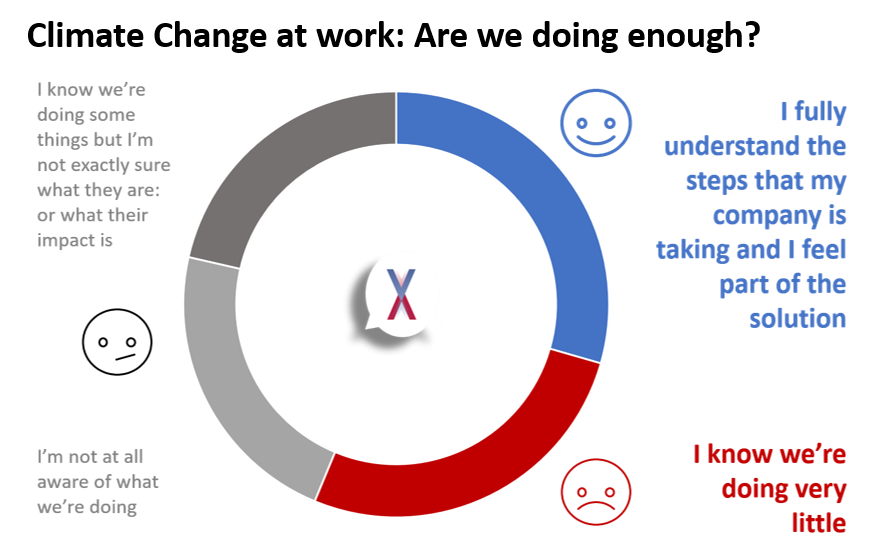

Whilst Greta Thunberg addressed the United Nations, only 30% of us could say that we felt properly informed and engaged what our firms are doing on climate change. A depressing 26% said they ‘knew their employers were doing very little’. That means that more people are ready for a no-deal Brexit than they are for a climate crisis.

But it’s not all the employers’ fault: 44% said of respondents aren’t properly informed on what their employers are doing or what the impact might be. Employers may not be leading the way but they are not seeing significant pressure from their staff.

Climate change needs a home

Corporate change needs accountability and resourcing: and climate change is no different. 24% of respondents cited the lack of competent, dedicated resources (who could drive climate change) as the single biggest corporate limitation in the struggle to address climate change. Those people, the logic goes, should not only deliver change – but also drive education on ‘what can be done’ (the second key limitation, cited by 21%). In the same way as conduct or innovation, climate change is the responsibility of everyone: but it requires a core group to drive it and shape the right behaviours.

Scarily, 18% of respondents also said that they couldn’t see a solid investment case for investing in ‘green’ projects.

Green Risk Management

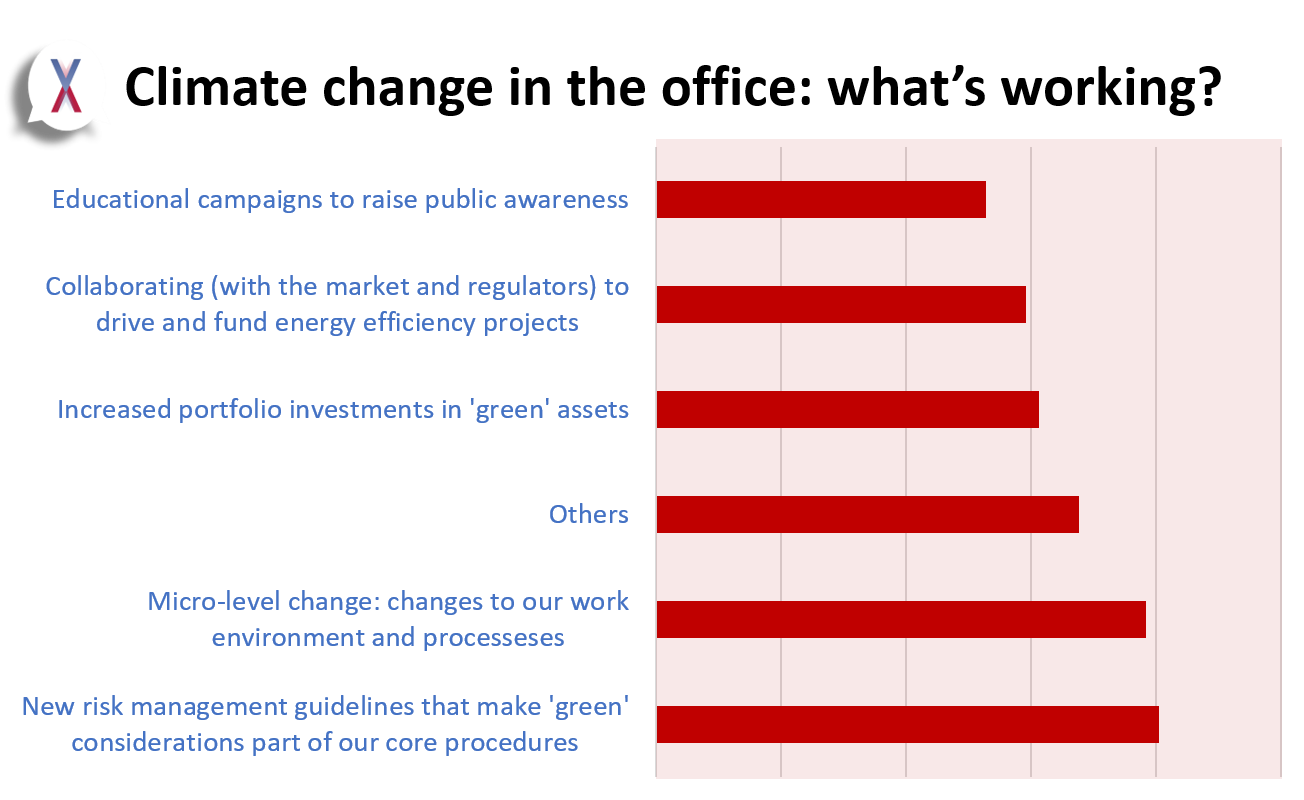

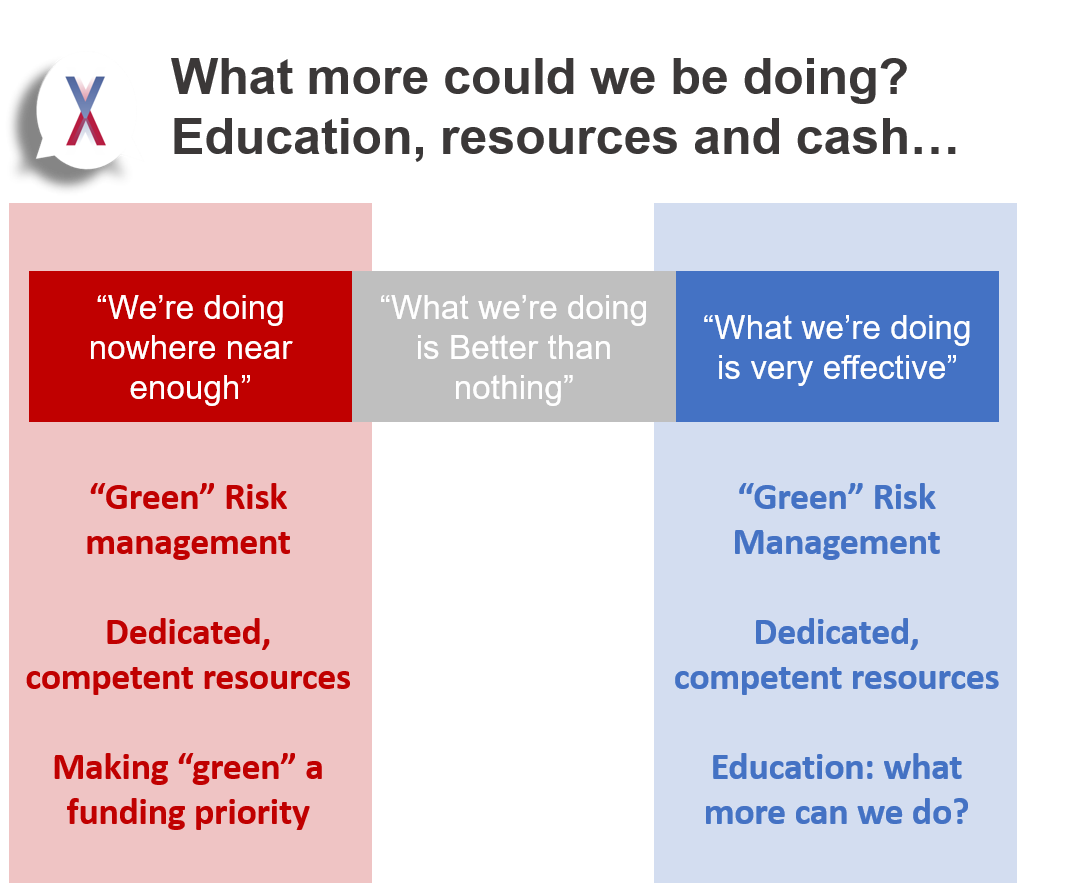

Gloom and doom aside, there’s a lot that people feel is working today: with respondents indicating at this stage that all action is good action.

So what is working best? People very clearly see the most effective measures as those being taken around them: most of all in the risk management frameworks that are the beating heart of every financial institution. 21% of respondents see the inclusion of ‘green’ factors in these daily, decision-making frameworks to be the single biggest potential impact that can be made in the financial industry – slightly ahead of micro-level changes in their office environments (19%).

But not everyone sees those as sufficient. Those who are most concerned by climate change want to see more hard-cash. Not only do they believe that dedicated resources are key (38%) – but they also want to make sure that ‘green’ projects get higher priority in the ongoing funding decisions.

And is all of this going to be enough? Sadly there is no clear view on where the effective change comes from: with almost an equal split of views between those who feel that what is being done is ‘enough’, ‘better than nothing’ or ‘nowhere near enough’ to significantly impact climate change.

The clear point though is that we should be trying much harder.

Dont forget to vote in October’s major survey on “2020 in perspective”

With next year looking to be as complex a year as ever, we are pleased to be introducing you to a new market-wide initiative that is designed to change the way that our industry manages its priorities and planning for 2020.

The ValueExchange’s “2020 in Perspective” survey is a new initiative supported by ASIFMA and the Network Forum: aimed at giving you the tools and benchmarks to understand how your view of 2020 compares with your peers across the globe.

From regulatory to internal or market-driven projects, this exercise will collect views from across the global investment cycle and help to turn them into actionable data: for you to see where you are perhaps bullish or bearish versus the market; to understand whether you are sufficiently investing in key regulations; and where you are building a unique edge.

The more you tell us the more we can tell you.

Please take 10 minutes to complete the survey (available here) and to share as many insights as you can.

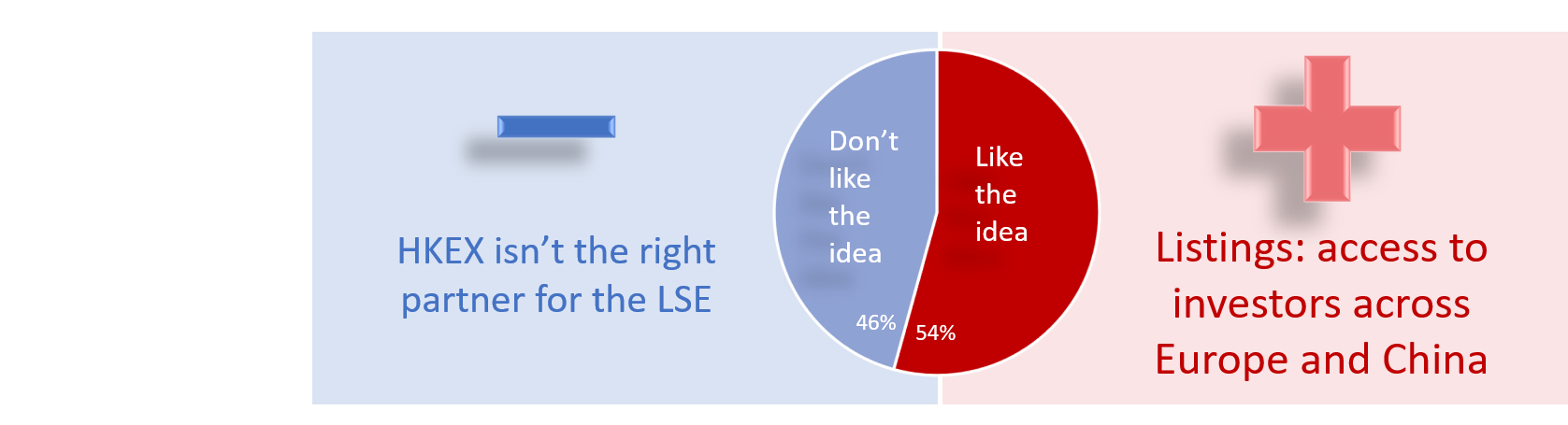

Poll details: This week’s poll was distributed to over 1,500 financial professionals across Asia, Europe and North America. For the sake of context, approximately 38% of respondents were located in Hong Kong; 20% in Europe. Views given above are based on how respondents ranked a number of positive and negative statements about the deal.