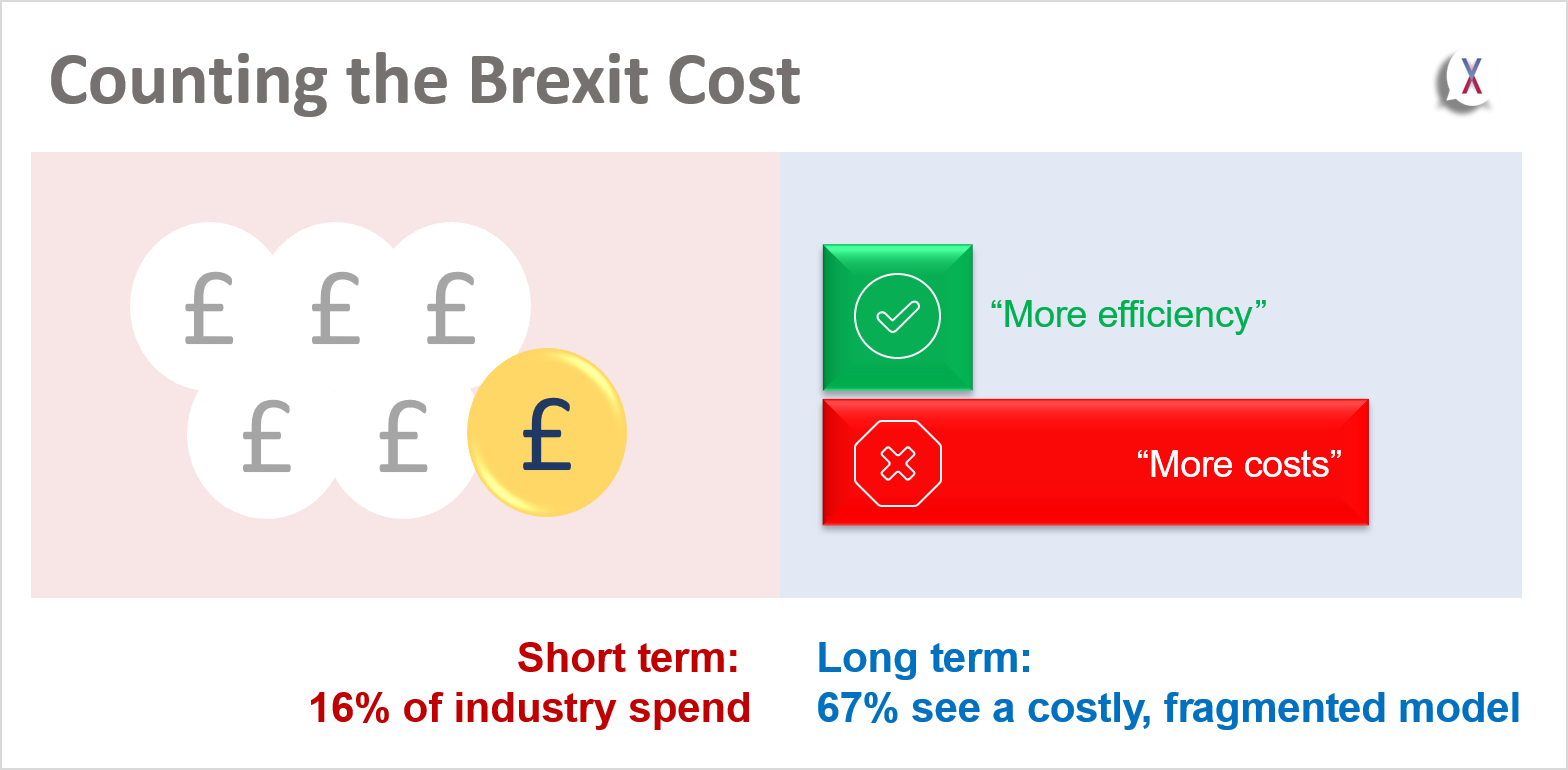

There is no doubt that Brexit is seen to be a huge operational expense for the financial services industry: both in terms of short term readiness and long-term operating costs. However, the good news is that the short term costs of preparing for Brexit may be behind us; and the longer term outlook could possibly not be as bad as we think: if we listen to the “experts”

Brexit-readiness: the biggest global project since the invention of the Euro

Preparing for Brexit has been a massive and expensive challenge for the industry. Approximately one-sixth of the industry’s resources have been on Brexit: with roughly 16c in every dollar (or pound) spent this year on making sure we’re ready.

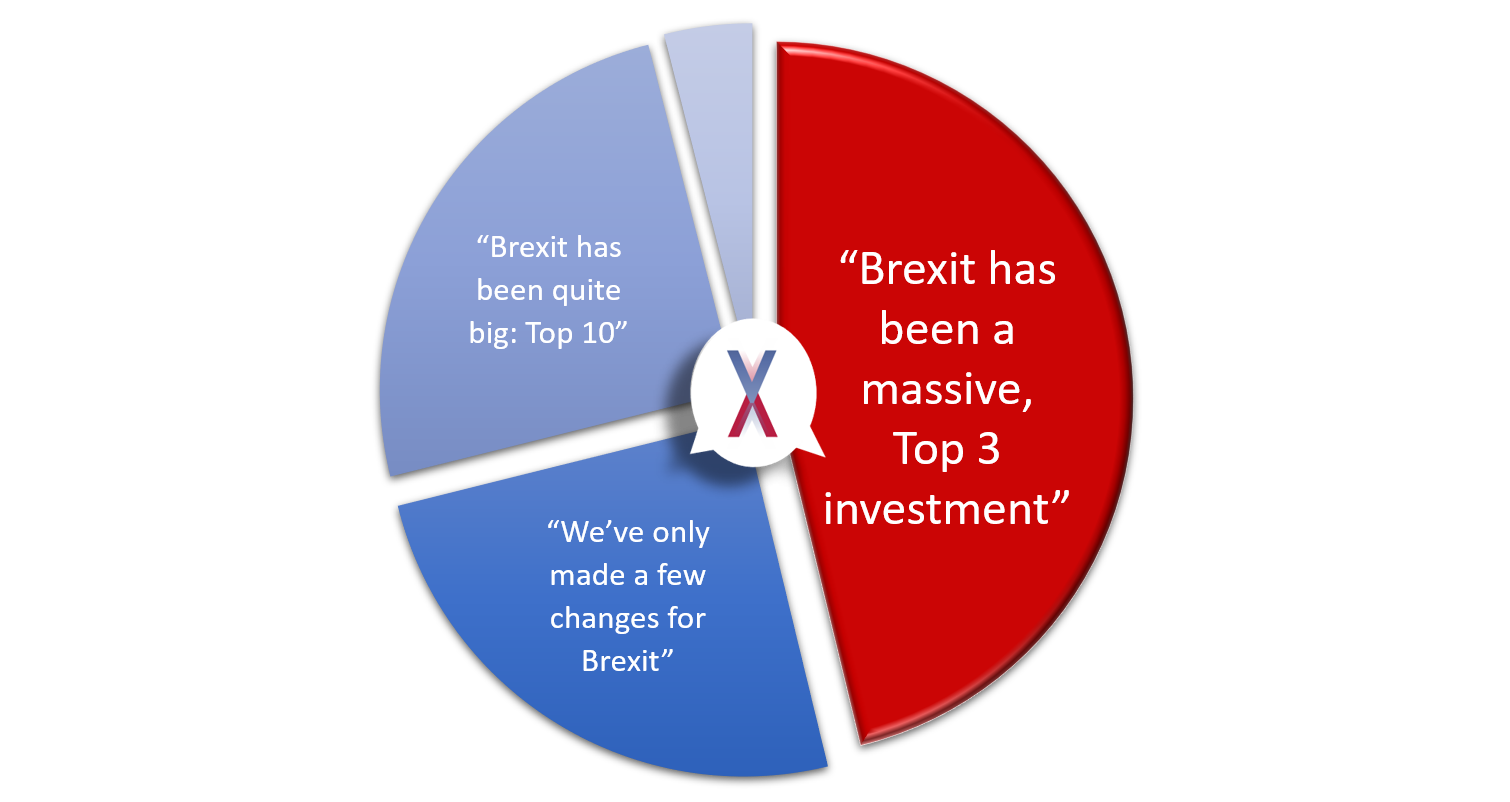

Preparing for all eventualities has been a Top 3 priority for 46% of the industry; and a Top 10 priority for 71% – leaving almost no one untouched globally. Given that this is a global poll, this is a universal impact – of a scale not seen since the creation of the Euro. Ironically.

But people have dealt with it in different ways. Alongside the 46% who have had to focus on this project almost at the exclusion of everything else, another 50% managed to continue their normal business whilst doing what they can to be ready. Perhaps this group have been waiting to know what exactly Brexit looks like; or perhaps they had a full book of business already – as they work to keep up with everything from CSDR to blockchain at the same time.

There is no debate though: the ticket cost of preparing for Brexit has been huge.

Is Brexit worth it?

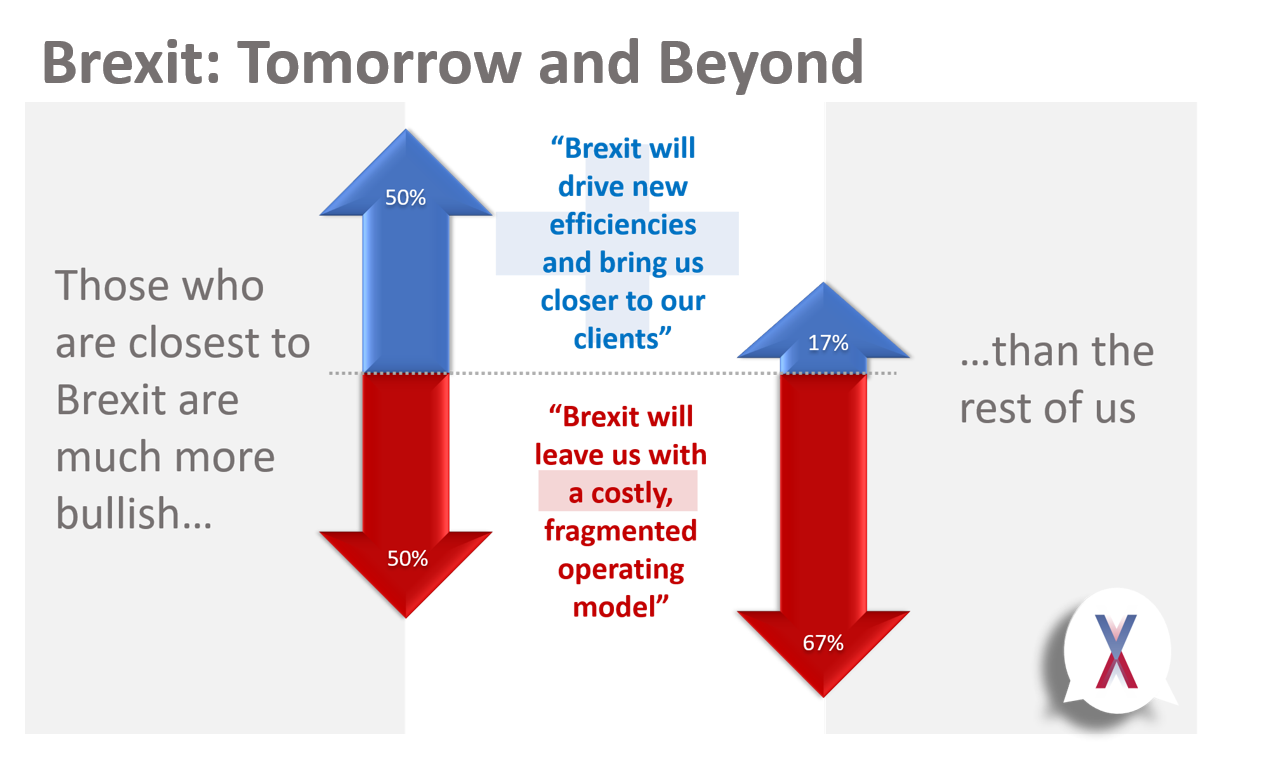

Politics aside, 67% of the industry say that the cost of Brexit will continue to run for years: as participants deal with the more costly, fragmented operating models that Brexit will leave behind. Added to the short term costs of readiness, these continuing Brexit-charges will no doubt, eventually, be passed on to consumers.

But not everyone is so downbeat. 17% of the industry believes that Brexit will drive new efficiencies by bringing participants closer to their clients and, potentially, forcing them to rationalize cost models that were overdue some attention. Importantly, this optimism is strongest amongst the ‘experts’ (those who have invested most in Brexit) with 50% seeing the exercise as beneficial in the long term. Could Brexit turn out to be a worthy operational investment?

Are we ready? We think so

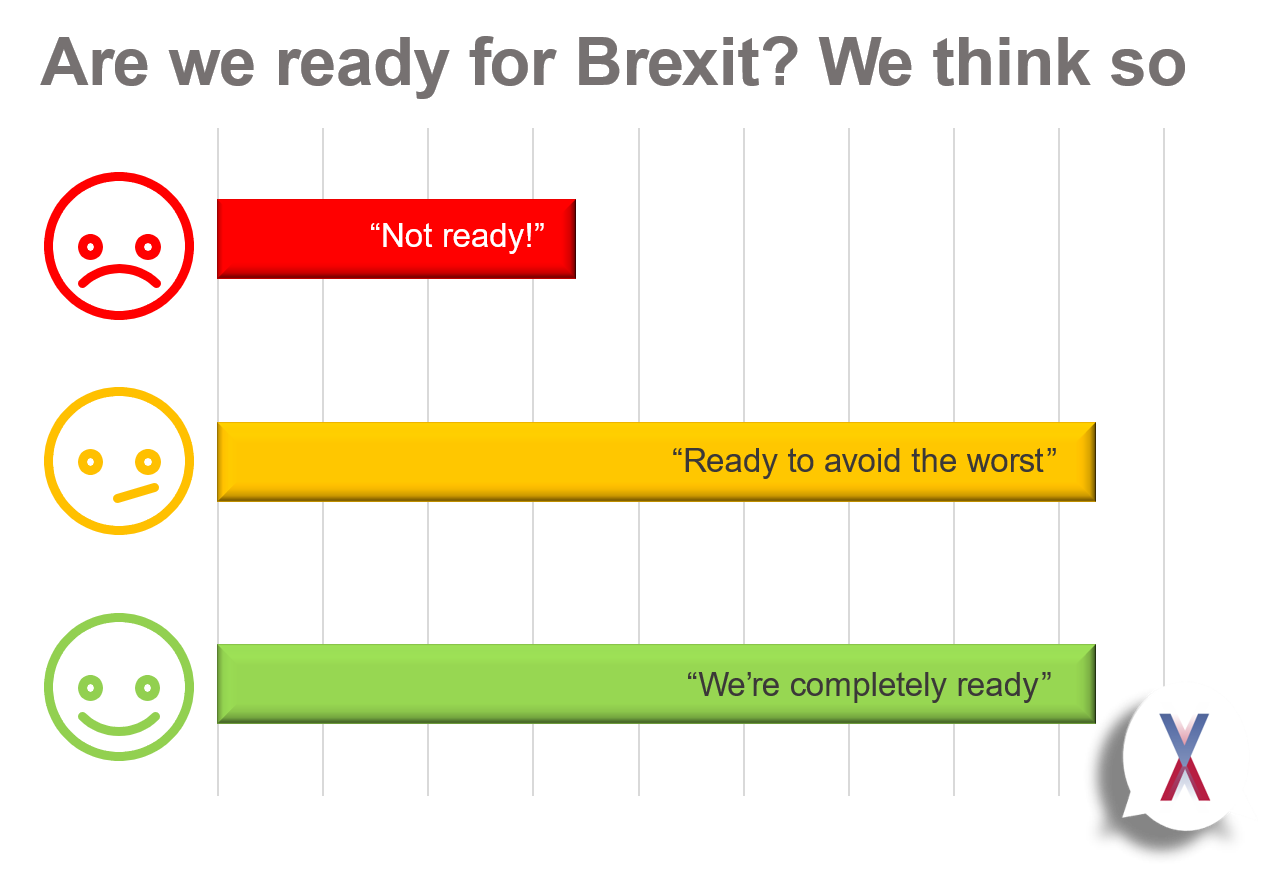

Across the industry, 83% believe that our preparations to-date will help us avoid the worst consequences of Brexit. A bullish 42% even believe that they are completely ready for whatever Whitehall and Brussels throw at them. After years of shifting sands, this certainty is striking: and hints at the fact that maybe, regardless of outcomes, we could soon be putting the logistical costs of Brexit behind us. Have we spent all we can spend and priced in all we can on this?

Possibly not. Whilst everyone clearly feels that they understand what they need to do to be fully ready (0% said they didn’t), those who have invested most in Brexit are the least optimistic in terms of our readiness. Only 20% of these ‘experts’ feel properly ready, with 60% hoping to survive the worst. Perhaps we still have more work ahead of us in 2020.

What to do now?

Brexit has always been – and continues to be – a story with two sides. Depending on who you listen to it can be everything from a great long-term investment to a massive, never-ending expense. With vast amounts of preparation now behind us, there is some consensus (or hope) that we have done enough to avoid the worst-case scenario and that 2020 could be a year of getting on with everything else.

Poll details

This week’s poll was distributed to over 1,500 financial professionals across Asia, Europe and North America. For the sake of context, approximately 38% of respondents were located in Hong Kong; 20% in Europe. Views given above are based on how respondents ranked a number of positive and negative statements about the deal.