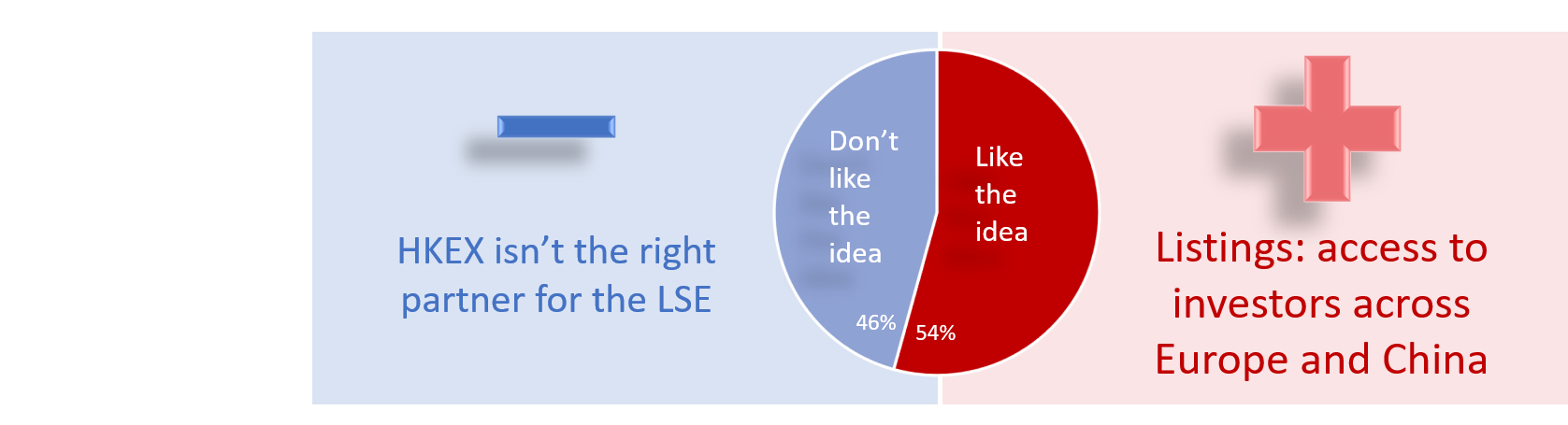

It’s a close call – but this week’s #vxbeat poll shows that global financial professionals are marginally in favour of HKEx’s proposed takeover of the LSE: although views are polarised depending on which side of the Urals you’re sitting in.

The headlines

The 54% to 47% margin is almost reminiscent of the Brexit-vote, with financial professionals citing the main benefit of the deal being a potential, global listings venue that would access Europe and China’s investors in a single venue.

Conversely, those wanting to see this deal fail focus mainly on the fact that the LSE could find better, future partners than the HKEx. After Nasdaq, TMX Deutsche Borse and now HKEx, that search may well continue…

Interestingly those in Singapore and Australia (where the last Exchange mega-merger was attempted) are split 50/50 on this deal: perhaps revelealing scepticism on the eventual fate of this scale of takevoer.

East vs West

Underlying the headline though is a hard-and-fast contrast: those in Hong Kong like the deal; and those in London absolutely don’t.

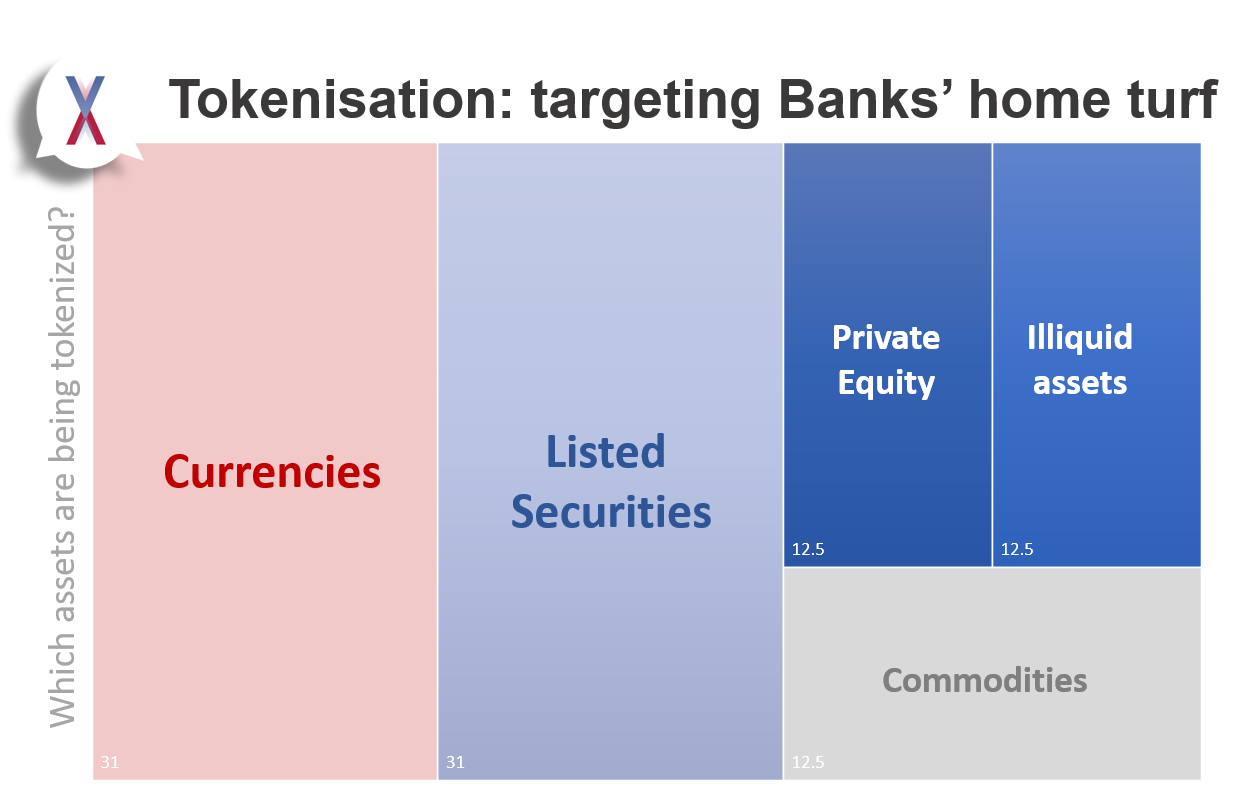

Hong Kongers (and professionals across Asia) are excited by the takeover: enticed by the potential power of a global listings venue that would reach investors in China (through HKEx’s China Connect), Hong Kong and Europe. That said, there is already skepticism that HKEx is paying too much for the LSE – despite analysts expecting that “that the price tag could go up as negotiation progresses”.

In London, it is hard to find anyone keen on the deal. Sadly we didn’t. The strong belief amongst our UK-based respondents was that there are not only better partners out there for the LSE, but that Shanghai Stock Exchange (with whom LSE recently launched another Connect programme) could be one of them. Fewer cited concerns around the deal’s impact on the LSE’s takeover of Refinitiv (and it’s strategic push into the world of market data) as a concern.

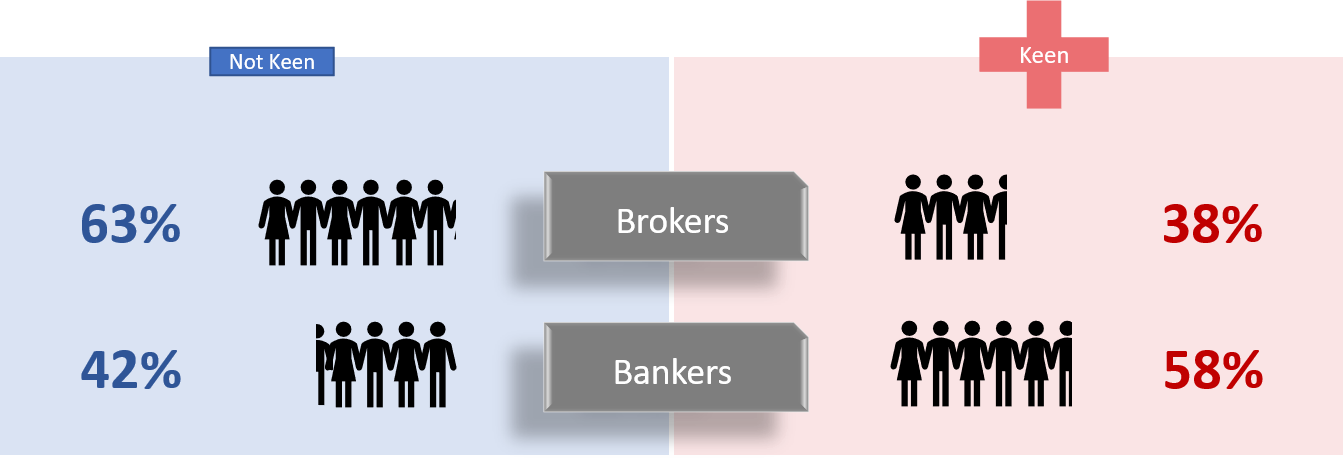

Brokers vs Bankers

A global listings-venue would no doubt suit the investment bankers of the world: but interestingly brokers and exchange-members seem much less excited.

What to do now?

Given that decision making now lies with LSE’s shareholders, the key question is whether they share the same views as our respondents. If they do then HKEx will have to strike a difficult balance: sweeten the deal to entice the LSE but not so much that HKEx’ existing shareholders believe that it’s too dear a deal to strike. In a week when Hong Kong’s credit outlook has worsened, this is going to be a challenge.

Please share these results as far and wide as possible! We need as many votes as we can to make these surveys matter. The more you share, the more we can tell you.

Powered by WordPress Support Service