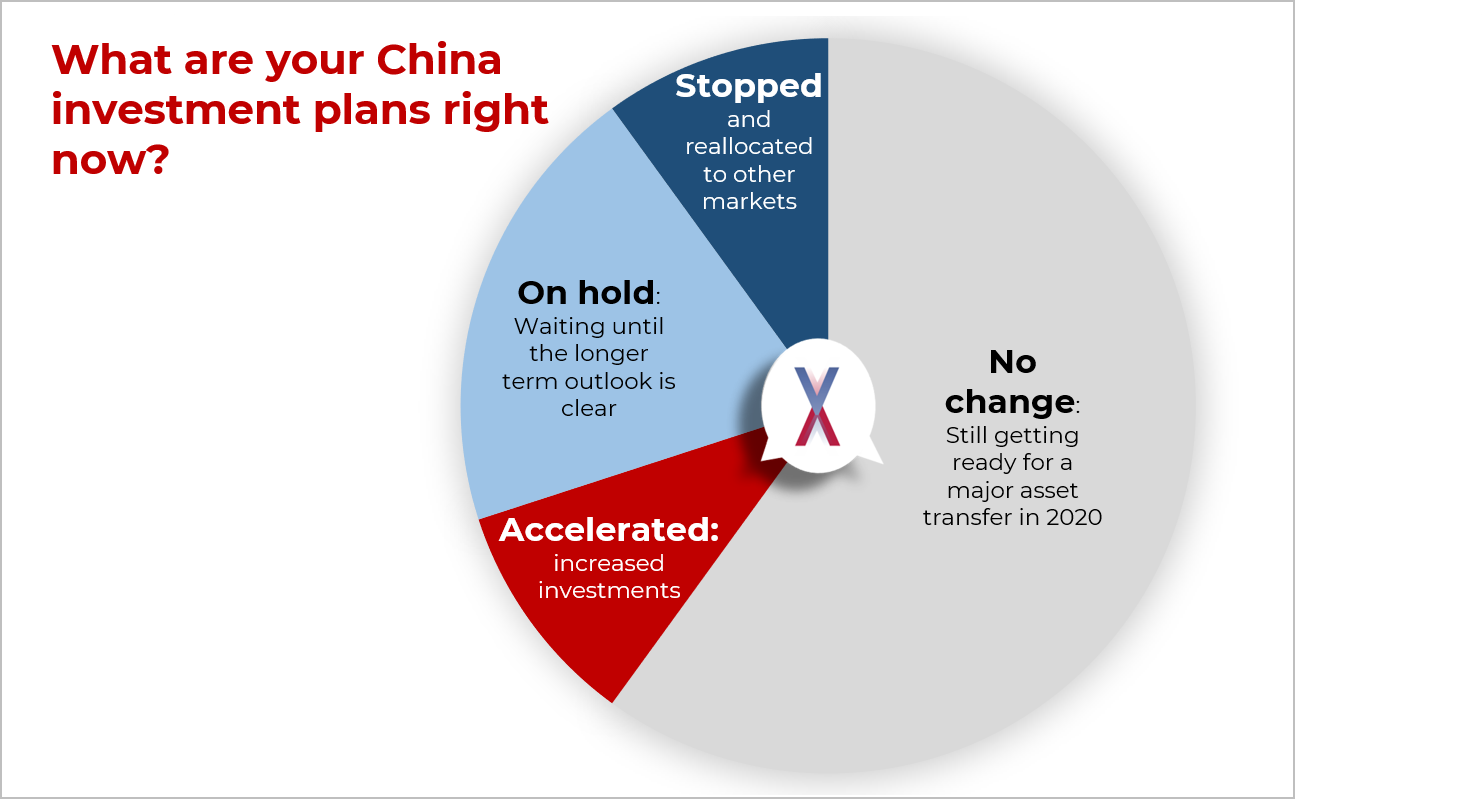

At the beginning of 2020, investors were projecting an increase of more than 60% in China flows this year. But how have the last several weeks changed that outlook and how are investors adapting?

So far the majority remains focused on the longer term outlook: with more than 60% of the industry still preparing for major increases in their China flows in 2020.

Not everyone is willing to wait though: 20% of the market is acting now to change their China plans. Of this group, investors are equally likely to be accelerating their China investments (because they see the current conditions as a buying opportunity) as they are to be pulling out entirely (and diverting investments into other markets). There are as many bulls as there are bears.

A further 20% of the market has put their China plans on hold: pending further clarity on the long term outlook.