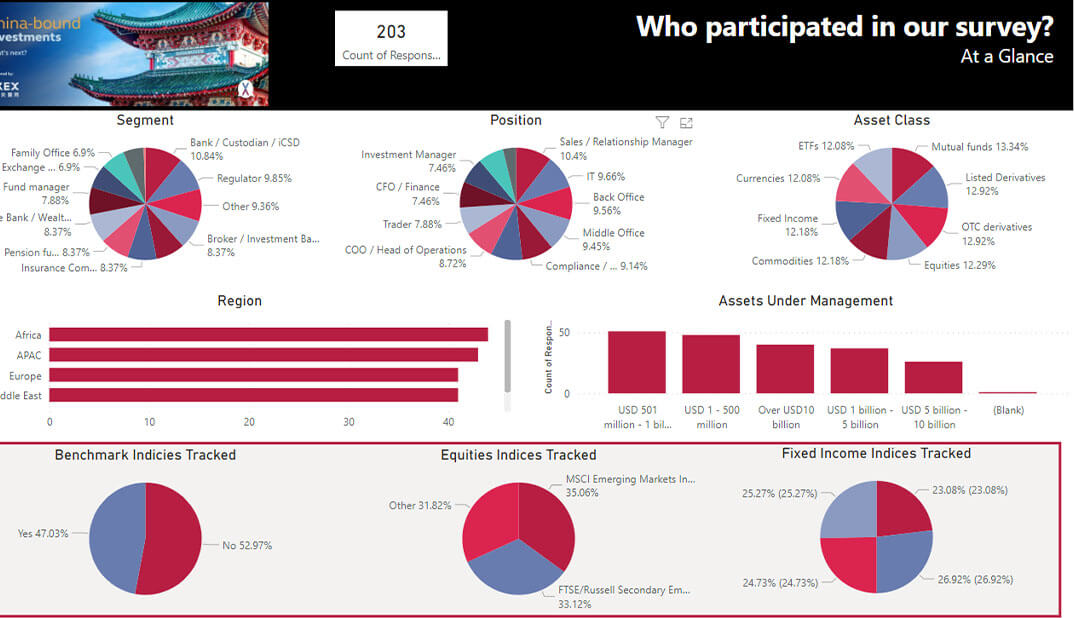

71% want to but only 30% do

Despite 71% of the industry seeing value in the metric, it was a great surprise to learn that only 30% of our industry is tracking a cost per trade in 2020 – least of all COOs. Although investors see costs per trade as closely linked to regulatory compliance (notably MIFID), brokers see accurate management of their trading costs as a source of competitive advantage.

Yet neither side is tracking more than half of their real trading costs. Misled in some cases by MIFID’s Transaction Cost Analysis guidelines, 50% investors are missing up to 45% of their costs behind every trade – overlooking out of pocket expenses and IT system costs most of all. On the sell side, half of the industry is missing up to 28% of their costs per trade – with the costs of risk and capital being the major areas of oversight.

These critical gaps in cost tracking are an urgent problem today: giving rise to incorrect resource allocations and driving the wrong behaviours. As new regulations (such as CSDR) take effect, poor cost visibility will mean that both the buy- and sell-sides face cost increases of up to 60% – without being able to track or control the cause.