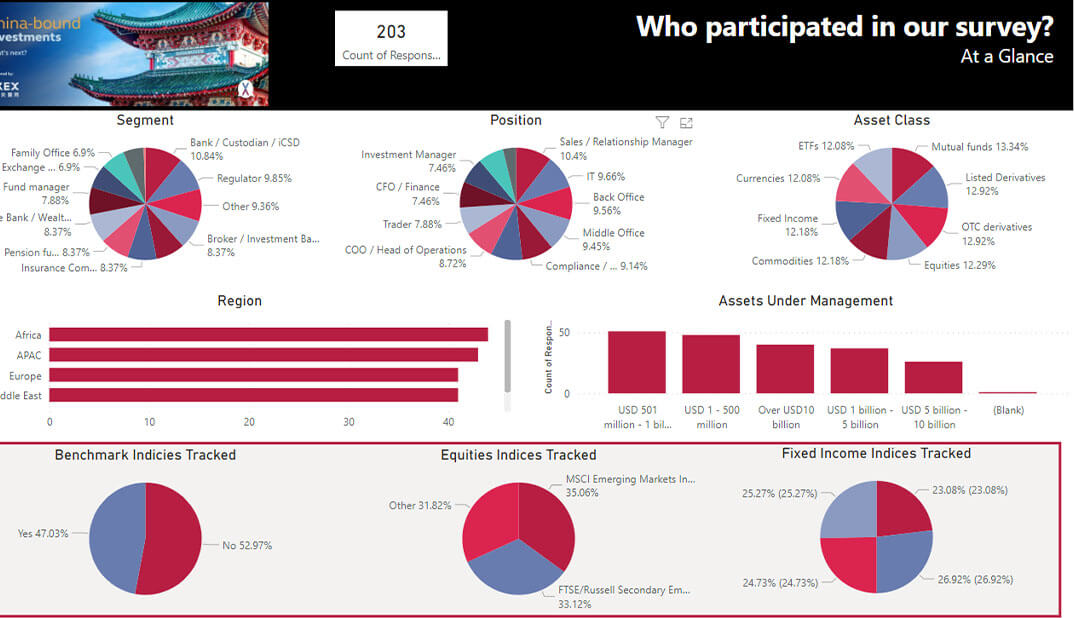

Simplicity and transferability as the new priorities

Today we are seeing a China Access story that is increasingly split into two parts.

For the first wave of experienced China players, we may have done enough to meet the technical criteria for index inclusion but there are continuing pressures to normalise market rules and to improve overall usability. The concept of fungibility and transferability between channels has come to the fore (as investors seek to remove risk by consolidating operating models) as have challenges in account opening (linked largely to continuing, high-pressure index inclusion events).

But in parallel we now have a constituency of newer China investors who, seeing China as an investment destination for the first time, expect the market to be as simple as any other: with one access route, one operating model and an application process that is simple. This puts great pressure on Banks and service providers to move away from today’s “what do you need?” complexity towards a simple “gateway” offering for China.

Tomorrow’s China roadmaps need to cater to that desire for simplicity – so that we can sustain the record-rate of asset flows from the last few years.