Many problems, one solution

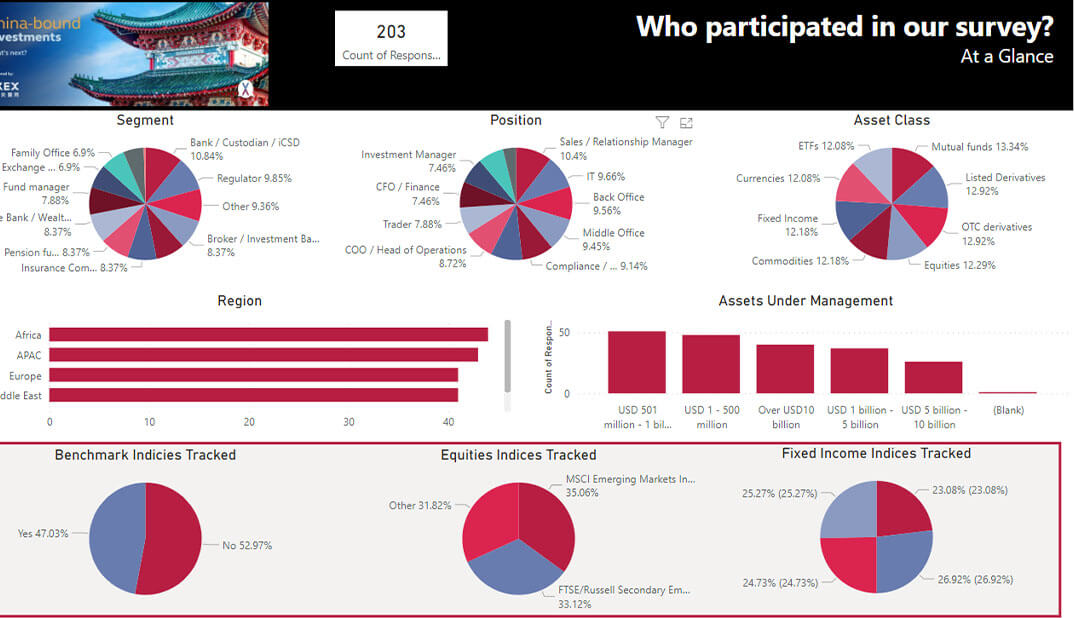

But where to start? There is no single corporate action problem – as challenges vary by investment activity, event type, customer profile and asset class.

Yet some key points stand out. In Asia-Pacific, interacting with market infrastructures is simply too manual – creating risks and latency issues downstream. In North America, manual processes still outweigh system issues as a source of problems for practitioners – as paper-based market practices continue to make manual intervention unavoidable. Only in Europe are practitioners preoccupied more by system limitations than by manual processes.

In an age of such incredible innovation “it feels very 1980s” for us to still be struggling with such core issues. The path to progress is not entirely straight forward, but it begins with collaboration and standardisation – as corporate actions are an ecosystem challenge above all.